Locate Your Ideal Protection: Medicare Supplement Plans Near Me

Locate Your Ideal Protection: Medicare Supplement Plans Near Me

Blog Article

How Medicare Supplement Can Boost Your Insurance Coverage Coverage Today

As individuals browse the intricacies of medical care strategies and look for comprehensive protection, comprehending the subtleties of supplemental insurance ends up being significantly vital. With a focus on linking the gaps left by conventional Medicare plans, these extra alternatives supply a customized strategy to conference specific needs.

The Essentials of Medicare Supplements

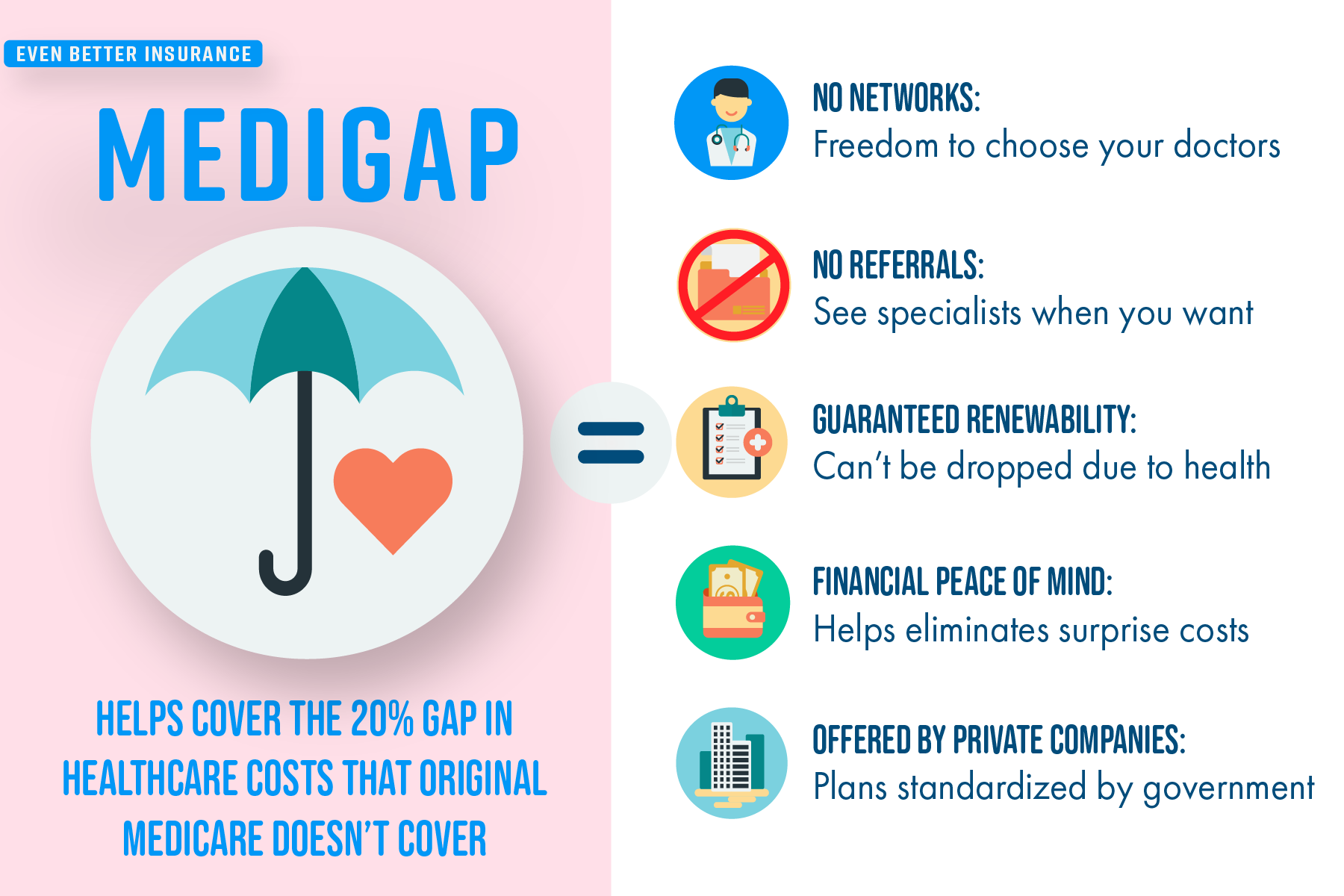

Medicare supplements, also called Medigap strategies, provide additional protection to load the voids left by initial Medicare. These supplemental plans are used by exclusive insurance provider and are created to cover expenditures such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Part B. It's necessary to keep in mind that Medigap plans can not be utilized as standalone plans but work together with initial Medicare.

One trick facet of Medicare supplements is that they are standardized across many states, using the very same standard advantages no matter the insurance company. There are 10 various Medigap strategies labeled A through N, each offering a different level of protection. For example, Strategy F is just one of the most extensive choices, covering nearly all out-of-pocket prices, while various other strategies might supply extra minimal insurance coverage at a lower costs.

Comprehending the fundamentals of Medicare supplements is important for individuals approaching Medicare eligibility who wish to boost their insurance policy protection and lower potential financial burdens related to healthcare expenses.

Understanding Insurance Coverage Options

When thinking about Medicare Supplement prepares, it is vital to comprehend the various insurance coverage alternatives to make certain thorough insurance policy defense. Medicare Supplement intends, additionally recognized as Medigap plans, are standard across a lot of states and identified with letters from A to N, each offering varying levels of coverage - Medicare Supplement plans near me. Additionally, some strategies might provide protection for services not consisted of in Initial Medicare, such as emergency treatment throughout international traveling.

Advantages of Supplemental Program

Comprehending the significant advantages of supplementary strategies can light up the value they bring to individuals looking for boosted medical care coverage. One key benefit of additional plans is the economic protection they give by assisting to cover out-of-pocket costs that initial Medicare does not completely pay for, such as deductibles, copayments, and coinsurance. This can result in substantial cost savings for insurance policy holders, especially those that need frequent medical solutions or treatments. In addition, extra strategies provide a more comprehensive array of coverage alternatives, including accessibility to healthcare providers that may decline Medicare task. This flexibility can be crucial for people who have details health care requirements or prefer specific medical professionals or experts. Another advantage of extra strategies is the ability to take a trip with peace of mind, as some strategies use coverage for emergency situation clinical solutions while abroad. On the whole, the benefits of extra plans contribute to a much more comprehensive and tailored method to medical care insurance coverage, guaranteeing that individuals can get the care they need without dealing with frustrating economic burdens.

Price Factors To Consider and Cost Savings

Provided the financial security and broader insurance coverage alternatives supplied by additional plans, an important element to think about is the expense considerations and look at this web-site potential savings they supply. While Medicare Supplement intends require a monthly costs along with the typical Medicare Component B costs, the benefits of reduced out-of-pocket prices often surpass the added expense. When evaluating the cost of supplementary strategies, it is vital to compare costs, deductibles, copayments, and coinsurance throughout site web different strategy types to determine one of the most affordable alternative based upon individual health care needs.

By choosing a Medicare Supplement plan that covers a higher percent of healthcare expenditures, individuals can decrease unforeseen costs and spending plan a lot more efficiently for clinical treatment. Inevitably, investing in a Medicare Supplement plan can provide valuable economic protection and tranquility of mind for recipients looking for extensive coverage.

Making the Right Selection

With a variety of strategies offered, it is essential to assess aspects such as protection alternatives, costs, out-of-pocket costs, service provider networks, and total value. In addition, reviewing your spending plan constraints and contrasting premium costs amongst different plans can aid make sure that you select a strategy that is affordable in the long term.

Final Thought

Report this page